Title IV-A Case Types

In this Topic

Types of Assistance

New Jersey offers assistance to low-income persons/families on the basis of the rules and eligibility criteria established by the Work First New Jersey Act, N.J.S.A. 44:10-34 et seq. The following are the major categories of assistance under the Title IV-A program:

- TANF: Receipt of TANF is limited to 60 months in a person’s lifetime; any exemptions must be consistent with N.J.S.A. 44:10-59(d) and 72(b). If a parent is absent from a TANF household, the CP or the specified relative is required to assist the CWA in pursuing child support.

- Medicaid: Provides health insurance benefits.

- General Assistance: Provides financial and medical assistance for low-income individuals without dependent children. Although General Assistance customers do not have children in their households, they must still cooperate with the child support program if they are the NCP for a child who is party to a child support casechild support case.

Assignment of Support Rights

When a CP applies for TANF or Medicaid, he or she agrees to have all child support payments made by the NCP directed to the CWA. These child support payments offset the assistance paid to the CP by the state. When a CP applies for TANF or Medicaid, he or she must agree to assign child support rights to the CWA, which then files its own complaint for child support and a health-care provision. All the support payments made by the NCP are directed to the CWA during the period of time the TANF case is open. This creates an Assignment of Support Rights. In accordance with 45 CFR 302.32(a); N.J.S.A. 44:10-49(a); and N.J.A.C. 10:100-6.1, 110-9.2(a)2(b), and 110-16.1(a), if an applicant qualifies for TANF, he or she will receive the cash assistance. If a child support order is obtained and the NCP pays the child support in any given month, the CP will receive up to the first $100 paid by the NCP on the 15th of the following month. This is called Child Support Disregard.

Example 1

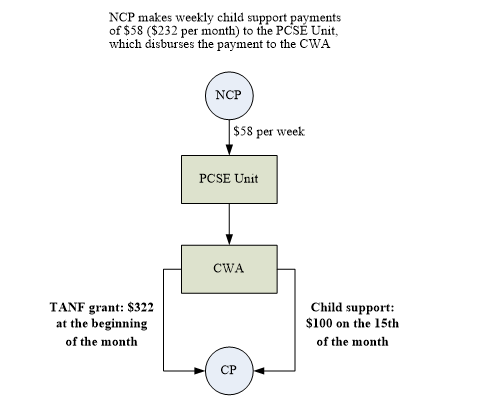

A CP with one child applies for TANF and is awarded $322 per month. The CWA obtains a child support order and the NCP is ordered to pay $58 per week (totaling $232 monthly) in child support. How much money will the CP receive on a monthly basis?

- The CP receives the monthly grant of $322 from the CWA at the beginning of the month on an EBT card.

- The NCP pays the ordered amount of $58 per week to the State Collection and Disbursement Unit— NJFSPC. Under certain circumstances, payments can be made to the local PCSE Unit, which disburses the funds to the NJFSPC.

- The NJFSPC forwards the support collected to the CWA.

- The CP receives the first $100 of the total child support amount of $232 from the CWA on the 15th of the following month.

- The CWA retains the remaining balance to offset the grant assistance issued to the CP for that month.

If the NCP is ordered to pay $5 per week (totaling $20 monthly) how much will the CP receive monthly? The CP will receive $322 per month plus the $20 child support payment, for a total of $342 per month. Why? Because the amount the NCP is ordered to pay is less than $100, the entire amount is given to the CP.

Note that Child Support Disregard applies only if the NCP is making current child support payments. If a payment is not made, the CP will not receive a credit on the 15th of the following month.

Example 2

A CP receives a TANF grant of $322 per month. In January of 2009, the CWA obtains a child support order, and the NCP is ordered to pay $45 per week ($180 per month). The NCP makes irregular payments during 2009 as follows:

| Month | Amount |

|

$0 |

|

$180 |

|

$360 |

|

$0 |

|

$0 |

|

$0 |

|

$180 |

|

$70 |

|

$180 |

|

$0 |

|

$360 |

|

$180 |

The CP receives the following Child Support Disregard payments:

| Month | Amount |

|

$0 |

|

$100 |

|

$100 |

|

$0 |

|

$0 |

|

$0 |

|

$100 |

|

$70 |

|

$100 |

|

$0 |

|

$100 |

The CP will also receive a payment in January 2010.

The CP will receive the $100 credit on an EBT card on the 15th of the month following the month a payment is made, even if the NCP is in arrears. If the NCP makes additional payments toward the arrears, the CP still receives only $100.

The CWA staff member must inform the CP that he or she will not receive support payments directly while on TANF; rather, the first $100 of the support amount will be credited to the EBT card on the 15th of the month after the support is paid. If the TANF case closes, the CP will receive a check on the 15th of the following month; the payment will not be credited to the EBT card.

In example 1, if the NCP makes a payment to the PCSE Unit on June 10, it will be credited to the CP’s EBT card on July 15. See figure below:

Assignment of Support Rights/Child Support Disregard Diagram

Cooperation

Federal and state laws under Title IV-A require cash assistance recipients to cooperate with child support authorities in establishing paternity and pursuing child support from NCPs. As a condition of eligibility for cash assistance, an applicant is required to cooperate with CWA efforts to establish paternity of a child born out of marriage and to establish and participate in the enforcement of child support obligationschild support obligations . Cooperation, as defined by the regulations, means the CP is making a good faith effort to provide information about the NCPNCP. Cooperation is divided into two categories: initial cooperation and full cooperation.

Initial Cooperation

Initial cooperation begins at the CWA interview when the applicant signs an affidavit of cooperation and provides information about the NCPNCP. The information on the NCP includes name, address, date of birth, Social Security Number, or “… all the requested information he/she reasonably can obtainobtain.” If the applicant does not have the required information but states that he/she can provide it, initial cooperation is granted, and the applicant has 30 days to provide the information. This can be extended an additional 30 days if the applicant can document that she/he is attempting to gather the necessary information but is having trouble doing so.

Full Cooperation

Full cooperation means that the applicant has fulfilled the requirements of initial cooperation and is further required to do the following:

- Appear at the CWA to provide additional information known to, possessed by, or reasonably obtainable by him or her him or her

- Appear as a witness at judicial hearingsjudicial hearings

- Appear and submit to genetic testing, as requestedas requested

- Provide information under oathunder oath

Once a recipient has fully cooperated, he or she is required to continue to make a good faith effort to cooperate with child support authorities during the establishment of paternity and the establishment, modification, and enforcement of child support orderschild support orders.

Full cooperation is determined by the CWA unitCWA unit, subject to a fair hearing or appeal through the Office of Administrative Law, in accordance with N.J.A.C. 10:90-9.3. If the applicant fails to cooperate, he or she and the children become ineligible for cash benefitscash benefits.

Exceptions to Cooperation Requirements

Although mandatory cooperation of recipients of child support is the rule, the regulations also provide Good Cause exceptionsGood Cause exceptions. The exceptions apply in situations in which compliance with cooperation requirements “…is not in the best interest of the individual, his/her children or the family membersfamily members.” The following table lists the exceptions to the cooperation requirements.

Good Cause Exceptions to Cooperation Requirements

| Exception | Explanation |

|

Domestic violence |

Past or present situations involving domestic violence in which the individual fears harm would be inflicted on the individual or the child(ren) if child support were pursued (N.J.A.C. 10:110-9.5(a)) |

|

Adoption |

The actual initiation of adoption proceedings or the applicant is currently being assisted by a private or public social service agency to decide whether to allow the child to be adopted (N.J.A.C. 10:110-9.5(e)) |

|

The custodian of the child is not the child’s parent, nor is the custodian related to the NCP (e.g., the custodian is a grandparent or other relative) (N.J.A.C. 10:110-9.5(k)) |

|

|

Extenuating circumstances |

The child was conceived as the result of a rape or incest-(N.J.A.C. 10:110 9.5(c) iii) |

In cases in which the individual claims Good Cause, he/she must sign an affidavit as to the truthfulness of the claim, in accordance with N.J.A.C. 10:110-9.5(b).

When the individual’s request is based on family violence, he or she is required to participate in a Work First New JerseyWork First New Jersey FVO. Even if a TANF applicant has not requested a Good Cause exception on the basis of family violence, he or she must be afforded a guarantee of confidentiality and safeguarding of information, as long as he or she has advised the CWA that family violence is an issuefamily violence is an issue. This information must be entered in the state automated system.

In those cases in which the factual background would support a Good Cause waiver for domestic violence, the CWA must pursue paternity and child support establishment and collections if the recipient has waived or does not request a Good Cause waiverGood Cause waiver. As long as the CP complies with the FVO assessment, a Good Cause exception will be grantedgranted. The granting of Good Cause exempts the individual from child support cooperation and relieves the CWA from the responsibility of pursuing child support, without penalty from federal audit for noncompliancenoncompliance.

Related Information

- N.J.A.C. 10:30-2.2(a)1]

- New Jersey Statutes Annotated (N.J.S.A.) 44:10-45(b); N.J.S.A. 2A:17-56.55; N.J.A.C. 10:110-9.1 through 9.4

- N.J.A.C. 10:110-9.4

- N.J.A.C. 10:110-9.2(a)1i

- N.J.A.C. 10:110-9.3(d)

- N.J.A.C. 10:110-9.3(g) 1

- N.J.A.C. 10:110-9.3(g) 3

- N.J.A.C. 10:110-9.3(g) 4

- N.J.A.C. 10:110-9.4(e)

- N.J.A.C. 10:110-9.2(a)1ii

- N.J.A.C. 10:90-9.3

- United States Code (U.S.C.) § 2015(l)(2); N.J.A.C. 10:110-9.5

- N.J.A.C. 10:110-9.5

- N.J.A.C. 10:90-20

- N.J.A.C. 10:110-9.5(c)3

- N.J.A.C. 10:110-9.5(c)(1)

- N.J.A.C. 10:110-9.5(j)1

- N.J.S.A. 2C:25-17

- N.J.A.C. 10:90-20

- N.J.A.C. 10:110-9.5(c)3

- N.J.A.C. 10:110-9.5(c)(1)

- N.J.A.C. 10:110-9.5(j)1

- N.J.S.A. 2C:25-17